Why choose

Lumi Bridging Solutions?

- 100% Independent

- Over 15 years industry experience

- In-house accountants and business analyst

- Hands-on experience in flexible bridging exits

- Dedicated commercial property finance projects team

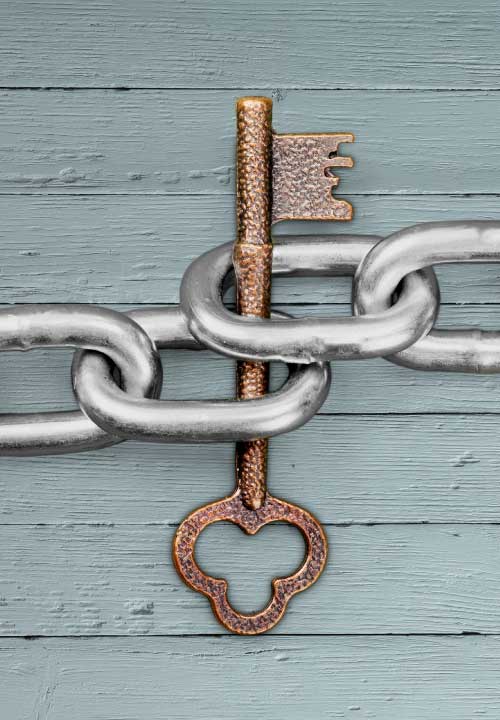

A delayed exchange or completion on the sale of your property does not have to mean you cannot complete your new home purchase or move…

A chain break Bridging Loan is generally used in the purchase of residential property. This type of short-term finance tends to be used where the buyer of your property is unable to exchange or complete on the purchase, or the buyer has pulled out of the purchase at the last minute. This in turn means you cannot exchange or complete on the purchase of the house you want to buy, which is extremely stressful and frustrating, particularly as the situation is not one you as the seller have any control over.

Unfortunately, this can occur in any length of property chain, but the longer a chain the greater a chance of a breakdown, and a knock-on effect for all parties involved up and down the chain that can bring all of the transactions to a standstill. More frustratingly, in many cases a break in the chain is not created by the immediate buyer purchasing your property.

Most conventional lenders will not allow two residential mortgages at the same time for an owner occupier, due to the risk based on affordability, so this is not an option to break the deadlock in the chain. However, a Bridging Loan could be an option to purchase the new property before the sale of your own property provided adequate security can be offered.

A Bridging lender will require security over your existing property and the new property you intend to buy which will allow you to complete the purchase on your new home and move in or carry out any works or renovations to the new property, whilst you await the completion of a sale on your existing home. The Bridging Loan then gets repaid from sale proceeds and a conventional mortgage can be put in place, should it be required as long-term finance solution on your new home.

Residential Bridging Loans are structured very differently to a conventional mortgage as they are secured against a percentage of a property or asset value and assessed by underwriters more on the exit strategy rather than the ability to service the loan for 25 or 30 years. A residential Bridge is a short-term loan designed to be repaid within a period of twelve months, and the interest on the Bridging Loan will be added to the loan, which is known as rolled up interest. This means there are no monthly repayments and the interest is added to the loan and paid at the same time the principal loan amount is repaid, upon the sale of your existing property, or when you obtain a conventional mortgage on your new home.

Lumi Bridging can help source an appropriate Bridging Loan to allow you to get on with your new purchase and break the deadlock in the chain, speak with one of our team today to get a better idea of your options and possibilities.

There are several factors that will influence the rate of interest set by lenders, they include:

- What the Bridging Loan will be used for.

- The type of property, the value of this property if using this as security against your loan.

- The size of the loan and the percentage this represents of the total value of the property or asset being offered as security against the Bridging Loan.

- The applicant’s or applicants credit history.

- Any other loans secured against the property, that will not be repaid by the Bridging Loan.

There is no restriction regarding age, making Bridging Loans open to anyone that can provide an acceptable property or asset that can be used as security. Although a Bridging lender may want additional security in some instances, in general, this will only occur when a property being offered does not meet the Bridging underwriters’ criteria in terms of value.

This is likely when the property being purchased is in need or renovation or will be demolished prior to a completely new building being constructed on the site of the new property being purchased, meaning the security being offered is, or may become insufficient in value to cover the Bridging Loan required.

As there is no ceiling on age, this gives those who wish to downsize or look for that forever home an opportunity to consider the whole of market for a suitable property at their leisure. In this particular instance a Bridging Loan offers the ability to make an offer, exchange contracts and complete on a purchase without the need to sell their existing home. This means one can confidently compete with other well positioned buyers not in a chain when viewing or making an offer to an agent or seller, so a cash or first-time buyer has no advantage or bargaining power in terms of how quickly they can exchange or complete on the purchase.

So now you can look for that perfect retreat without the need to sell your home or likelihood of losing out to someone who can simply move quicker. A Bridge also offers greater control over the whole transaction and gives you a strong hand so you can take time to plan your move without compromise and more importantly, at your own pace.

The timeframe is largely dependent on the applicant providing all of the relevant information required to complete an application to a lender, but in most cases Lumi can provide a preliminary offer within 24-48 hours dependent on the time of day an application is made to a lender. Full Heads of Terms can usually be obtained within 5-7 working days, subject to all relevant approvals from solicitors and valuating bodies, completing their roles within the timeframe (Not to be confused as a deadline). Thereafter most applications can be completed very quickly.

Using Lumi Bridging to find the right lender to break that chain is easy and straight forward, in general terms a borrower can request up to 75% of the value of property. This means you’ll need a minimum of 25% as a deposit. Depending on the ‘Loan to Values’ (LTV) required, a lender may look to reduce the amount of Bridging Finance based on the nature or condition of the property, your personal circumstances and what will the loan be used for.

The basic requirement to make a Bridging Loan application are:

- You a based in the United Kingdom.

- You are aged between 18 – 85 years.

- You have a property or other asset that can be used as security.

- You have a deposit or existing equity of at least 25% of the amount you wish to obtain as a Bridge.

- The Bridging Loan does not exceed 75% of the property value.

- Your current employment does not place you at risk of redundancy.

- You are not on a deferred payment plan or on furlough.

How do I apply?

The simplest way to apply for a Bridging Loan is to speak to one of our team who can compile a comprehensive list with you over the phone of the basic information most lenders require to make any Bridging Loan application. These tend to be the following:

- Your personal details, including your full name. permanent residential address.

- Full details of the property or properties you wish to take a Bridging Loan out against.

- The purpose of the Bridging Loan.

- The timeframe you believe you will require the Loan

- Your planned exit strategy to redeem the Bridging Loan.

- Proof of income and at least 3 months personal bank statements.

- You may also need to prove the source of deposit funds.

Criteria overview

- Competitive and flexible rates

- Up to 100% LTV with additional security.

- Terms from 3 to 18 months

- Adverse credit considered

- Loans from £25K to £50M

- 1ST and 2ND charged lending

Request a call back

Helping you choose the right bridging finance for your residential or commercial moves

Commercial Bridging Finance

Looking to buy a commercial property or need funds for another business purpose?

Buy to Let Bridging

Buying at auction or a property for refurbishment?

A bridge can give you funds fast to complete that quick purchase.

Bridging Finance to break that chain

Need a bridge until you can sell your current home, or simply release funds for another project.

Borrow from £25,000 to £15,000,000

No matter how much you want to borrow, we will do our best to make it happen, without the fuss or headache.

Rates from as little as 0.37% per month

Lender’s rates change regularly, so we always scan the market to get the best rate for your specific circumstances.

Make use of our in-house accountants

Their expertise and experience are part of our service and at your disposal.

Contact us today for your bridging finance, buy to let mortgage, commercial mortgage, bridging loan for house purchase, HMO purchase, emergency cashflow loans, auction finance, bridging loans for property development, bridging loan mortgage, business bridging loan, commercial development financing.

Bridging finance for your commercial or residential property

LUMI BRIDGING SOLUTIONS IS A TRADING NAME OF FEINGOLD FINANCIAL SERVICES LIMITED

Company registration number 05087823. FCA registration number 303451. Data protection registration number Z8766562

Registered office: 1st Floor, Swan Buildings, 20 Swan Street, Manchester, M4 5JW.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE SECURED AGAINST IT.